what percent is taken out of paycheck for taxes in massachusetts

Despite being the 6th smallest state in the country in size Massachusetts is one of the most populated states in the US. For instance Blau and Kahn 2016 find an unadjusted penalty of 207 percent a partially adjusted penalty of 179 percent and a fully adjusted penalty of 84 percent10 But switching to a fully adjusted model of the gender wage gap actually can radically understate the effect of gender discrimination on womens earnings.

Paying electronically is quick easy and faster than mailing in a check or money order.

. Womens business centers--The Administration shall award 20 percent of funds authorized to carry out this subsection to womens business centers which shall be awarded pursuant to a process established by the Administration in. The United States has the most technologically powerful and. This rate does not reflect the additional 09 percent in Medicare taxes certain high-income taxpayers are required to pay.

Again the money taken out of your pay is pre-tax dollars. There is appropriated to the Secretary of Agriculture for fiscal year 2021 out of any money in the Treasury not otherwise appropriated 4000000000 to remain available until expended to. Specifically the TCJA generally limited interest expense deductibility to 30 percent of earnings before interest taxes depreciation.

Massachusetts high housing costs are pushing out workers. Modifications to paycheck protection program. Since you have not yet paid taxes on this portion it is taxable when you receive it in the form of a lump-sum payment or if you roll over this portion to an eligible retirement plan when you eventually receive these funds.

Alabama and Louisiana have the highest average local option sales taxes 522 and 510 percent respectively and in both states the average local option sales tax is higher than the state sales tax rate. The state has a flat tax system with a rate of 5499 percent that applies to all incomes. From a mobile device using the IRS2Go app.

To find the state wage garnishment rules in your state visit the website of your state department of labor. Its population is estimated to be around 694 million up from the 654 million estimate from the 2010 census. Other states with high local option sales taxes include Colorado 482 percent New York 452 percent and Oklahoma 445 percent.

Federal government websites often end in gov or mil. According to this survey the amount of time American office workers say they devoted to their actual duties declined from 46 percent in 2015 to 39 percent in 2016 owing to a proportionate rise in time dealing with emails up from 12 percent to 16 percent wasteful meetings 8 percent to 10 percent and administrative tasks 9 percent. For example in Massachusetts most judgment creditors can only garnish up to 15 of your wages.

Before sharing sensitive information make sure youre on a federal government site. How much you can save in taxes depends on your tax bracket and your state andor local income tax rates. The remainder forward to future years.

Delay of payment of employer payroll taxes. The United States is a highly developed country with a free market economy and has the worlds largest nominal GDP and net wealthIt has the second-largest by purchasing power parity PPP behind China. Pandemic shows little sign of quitting.

Millennials also known as Generation Y or Gen Y are the demographic cohort following Generation X and preceding Generation ZResearchers and popular media use the early 1980s as starting birth years and the mid-1990s to early 2000s as ending birth years with the generation typically being defined as people born from 1981 to 1996. Share of Arizona jobs once held by undocumented immigrants that were filled by US-born workers and legal Hispanic immigrants by 2015. Most millennials are the children of.

TITLE V--COMMITTEE ON SMALL BUSINESS AND ENTREPRENEURSHIP Sec. That means the potential maximum credit is 600 20 percent of 3000 for the care of one person and 1200 for. The dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding 200000 head of household or 400000 married filing jointly.

Faster ways to file your return. This typically works out to between 50 and 325 of the retirement beneficiarys Primary Insurance Amount. Copy and paste this code into your website.

See chapter 1 later. 807 billion On private prisons and jails. Massachusetts b 1105.

Decrease in the total number of jobs available in Arizona due to the passage of SB 1070 2008-2015. Bb The standard deduction is 15 percent of income with a minimum of 1550 and a cap of 2350 for single filers and married filing separately filers. The credit is 20 percent for anyone earning 43000 or more.

4000 Annual cost to families of prison phone calls and commissary purchases. Modifications for net operating losses. It had the worlds eighth-highest per capita GDP nominal and the ninth-highest per capita GDP PPP in 2022.

Government expenses on public prisons and jails. For employees and employers combined the OASI payroll taxes are 106 percent and the DI payroll taxes are 18 percent. 310 Number of companies that profit from mass incarceration.

Or in cash or by check or money order. Both methods of taxation increase taxable income beyond what it would have been had the business not taken. 39 billion Growth in justice system expenditures 1982-2012 adjusted for inflation.

The gov means its official. With Worcester residents to vote on Community Preservation Act this fall report says city could raise 37 million in first year. While not a high rate overall it takes a toll since it starts with the first dollar of income.

It has articles on wage garnishment laws in each of the 50 states. Florida unemployment rate down to 27 percent Floridas unemployment rate dipped to 27 percent in July matching the level before the COVID. In 2019 trust fund reserves for the OASI and DI programs were 28 trillion and 93 billion respectively.

Or check out Nolos State Wage Garnishment page. Cost-of-Living Adjustment percent 20. Via The Boston Globe.

State taxes are straightforward in North Carolina but the net result for state residents is still a below-average take-home pay rate. Self-employed persons pay a total of 153 percent124 percent for OASDI and 29 percent for Medicare. Contributions to the CT Paid Leave fund are made by each employee in the amount of one-half of one percent 05 of his or her salary taken as a deduction from each paycheck up to the Social Security contribution limit.

2 E STIMATED TAXESFor purposes of applying section 6654 of the Internal Revenue Code of 1986 to any taxable year which includes any part of the payroll tax deferral period 50 percent of the of the taxes imposed under section 1401a of such Code for the payroll tax deferral period shall not be treated as taxes to which such section 6654. After January 1 1988 all contributions were deducted from your paycheck before taxes were taken out. You can pay your taxes by making electronic payments online.

The employee contributions are deposited in the CT Paid Leave Trust Fund which funds all of the paid leave benefits.

A Complete Guide To Massachusetts Payroll Taxes

Massachusetts Paycheck Calculator Smartasset

Sales Tax Holidays Politically Expedient But Poor Tax Policy

A Complete Guide To Massachusetts Payroll Taxes

Massachusetts Income Tax H R Block

How Do State And Local Individual Income Taxes Work Tax Policy Center

Ma Pfml Claims Faq Usable Life

Here S How Much Money You Take Home From A 75 000 Salary

Payroll For North America Updates State Paid Family And Medical Leave Quest Oracle Community

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Massachusetts Income Tax Calculator Smartasset

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Tax Year 2022

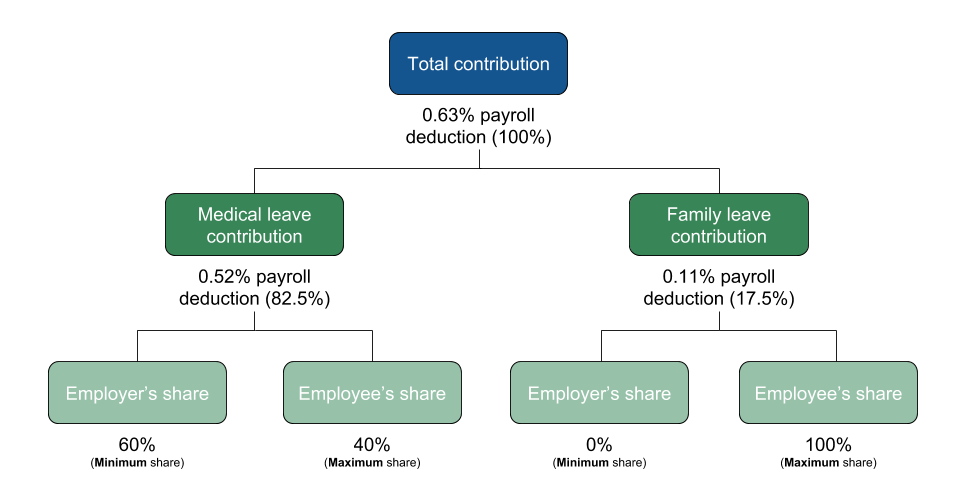

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Learn More About The Massachusetts State Tax Rate H R Block